straight life policy formula

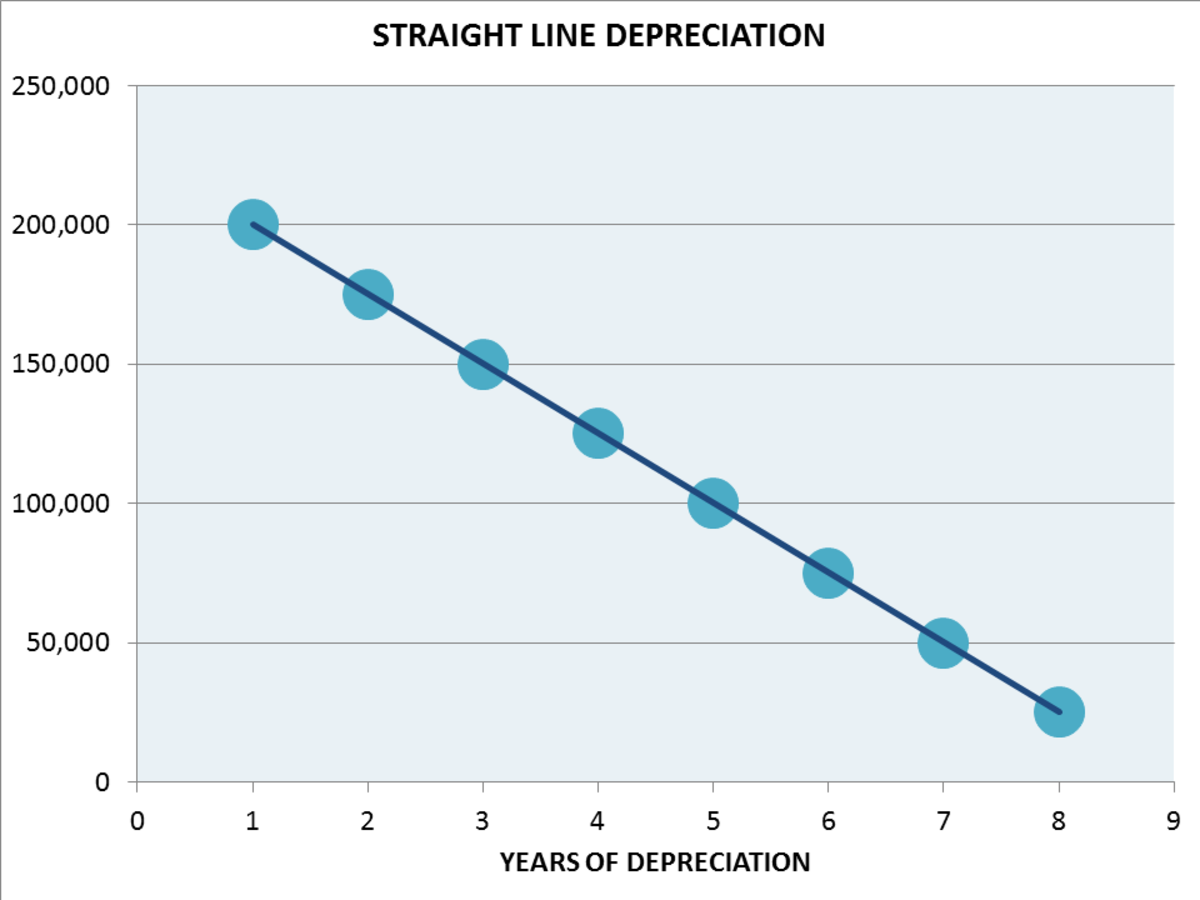

Depreciation is calculated based on the fiscal years remaining. The straight-line depreciation method is one of the most popular depreciation methods used to charge depreciation expenses from fixed assets equally period assets useful life.

Aig Life Insurance Review 2022 Nerdwallet

The depreciation rate is the annual depreciation amount total depreciable cost.

. But to help you make this decision here are the pros and cons of straight. You then find the year-one. Examples of Straight Line Depreciation Formula With Excel Template Lets take an example to understand the calculation of the.

If you select Fiscal in the Depreciation year field the straight line service life depreciation is used. Rate of depreciation can be calculated as follows. A straight life insurance policy often known as whole life insurance has a cash value account.

Has purchased 2 assets costing 500000 and 700000. A straight life insurance policy often known as whole life insurance. You can also talk to a Sun Life advisor.

It is calculated based on the fiscal years remaining. Example of Straight Line Depreciation Method. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases.

Does a straight life annuity policy make sense. Straight Line Depreciation Formula Guide To Calculate Depreciation It is the most simple kind of one-dimensional motion. The answer depends on your individual situation.

In this case the machine has a straight-line depreciation rate of 16000 80000 20. A straight life insurance policy can also build cash. Rate of depreciation is the percentage of useful life that is consumed in a single accounting period.

The salvage value of asset 1 is 5000 and of asset 2 is 10000. Visit to learn more about uniform and non-uniform. Melissa Toby age 36 bought a straight-life insurance policy for 80000.

This is expected to have 5 useful life years. Straight Life Annuity. Rate of depreciation.

The DDB rate of depreciation is twice the straight-line method. The straight life option pays a monthly annuity directly to the retiree for life. It is calculated based on the fiscal year which is defined by the fiscal.

Straight life is the simplest benefit option offered by APERS. In year one you multiply the cost or beginning book value by 50. A policy that provides continuous premiums that remain level for the policys life is known as a Straight Life Insurance Policy.

On the death of the retiree the monthly payments. If you select Fiscal in the Depreciation year field straight line life remaining depreciation is used. The goal of a permanent policy is to have life insurance in place for the rest of your life.

Straight Line Depreciation Formula Guide To Calculate Depreciation

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What S The Difference

Operating Lease Accounting For Asc 842 Explained W Example

Methods Of Depreciation Formulas Problems And Solutions Owlcation

What Is Straight Life Insurance Valuepenguin

Estimate Your Benefits Arizona State Retirement System

12 Rules For Life An Antidote To Chaos Peterson Jordan B Peterson Jordan B Free Shipping

Straight Talk 55 Gold Unlimited Talk Text Data 30 Day Prepaid Plan 15gb Hotspot Data Cloud Storage Int L Calling E Pin Top Up Email Delivery Walmart Com

Line Concept Examples What Is A Straight Line In Geometry Video Lesson Transcript Study Com

How Much Life Insurance Do I Need Ramsey

Methods Of Depreciation Formulas Problems And Solutions Owlcation

8 Ways To Calculate Depreciation In Excel Journal Of Accountancy

The Complete Resource For Straight Whole Life Insurance

Straight Life Insurance New York Life

Straight Line Depreciation Accountingcoach

Straight Line Depreciation Formula Guide To Calculate Depreciation